We live in a highly competitive business environment where your next biggest commercial threat may come from someone’s garage or bedroom. Under these circumstances, the ability to be agile and innovative is no longer just desirable but is now essential if businesses are to survive longer-term.

Disruption has become the norm!

Disruption with associated productivity gains can be found in the rapidly growing use of location intelligence. Underlying geospatial data analytics platforms are leading the way in exposing insights that enable faster and more accurate business processing. An area that has begun making use of this capability is in banking, which is under competitive threat from neo-banks, and retailers moving into wider financial transaction management.

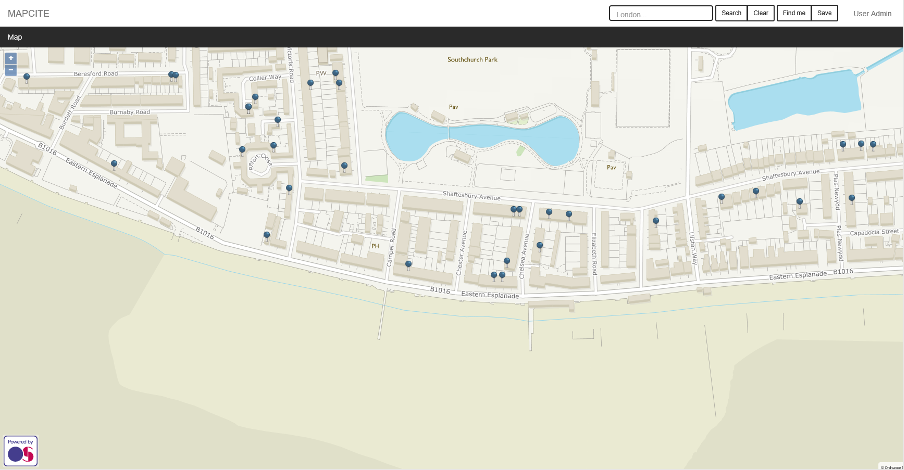

Take Mapcite’s innovative “Instant Mortgage” solution making banks more customer-responsive and process efficient.

Working with one of the largest banks in the world Mapcite helped conceive the Instant Mortgage which produces three key outputs:

- A better understanding of the bank’s risk on all new and existing mortgages.

- Optimised automated decision making on mortgage applications.

- Encourage mortgage participants to select properties that the bank wants on its books as their properties of choice.

The problem the banks face is which properties do we want to proactively assess to underwrite with a mortgage: if we can create this knowledge using the Mapcite platform then the bank can optimise the mortgage application process. Improving the consumer journey and saving the customer money by reducing the reliance on physical survey or AVM.

Optimising property risk assessment with Location Data

Mapcite working with the Ordnance Survey (UK Mapping Agency similar to PSMA in Australia) to identify 54 separate datasets that pertain to property risk and information that would normally be used in a building assessment survey prior to obtaining a mortgage. They then defined a number of algorithms that blended all this data together, creating a benchmark rating for a particular property. This benchmark rating related to internal business rules and would lead to a yes or maybe decision on any single property’s desirability for the bank.

The risk assessment calculation was then run for every property in the country thus identifying:

- Overall mortgage risk exposure.

- Immediate yes, or “talk to us” decisions on all properties.

- The ability for the bank to specify from a list of properties for sale, which properties the bank wants to mortgage against for the information of their client proactively… The Instant Mortgage.

The overall time for risk analysis of mortgage applications for properties using the Instant Mortgage could be reduced from weeks, down to minutes.

Finally, in an interesting twist from this initiative, it was discovered that when the Instant Mortgage process was run across existing held mortgages, some 5%+ were well outside the bank’s risk profile/appetite!